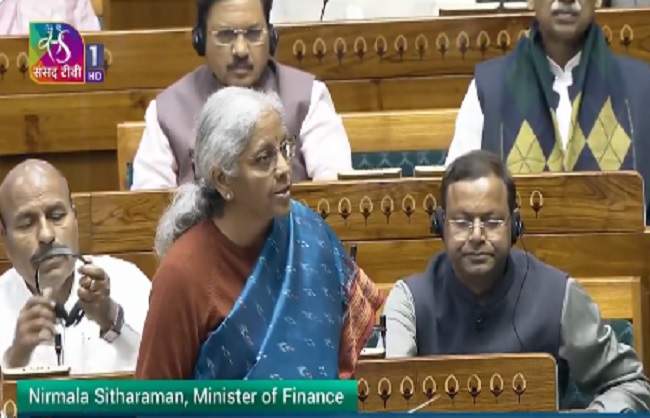

New Delhi, February 13: Union Finance Minister Nirmala Sitharaman on Thursday introduced the long-awaited New Income Tax Bill-2025 in the Lok Sabha. The new Income Tax Bill has been sent to the Select Committee. With this, the proceedings of the Lok Sabha have been adjourned till 11 am on March 10.

Union Finance Minister Sitharaman, while introducing the new Income Tax Bill-2025 in the Lok Sabha, said, “We are reducing the number of income tax sections to 536.” He said that along with the reduction in the number of chapters in the Income Tax Bill, important changes are being made.

He said that the purpose of this bill is to make major changes in the 64-year-old Income Tax Act.

The new Income Tax Bill-2025 has been brought as a revolutionary change in the existing income tax system and statutory provisions of India, which repeals the old Income Tax Act, 1961 in line with the progress and economic realities of the 21st century. In fact, this 622-page bill will replace the 6-decade-old Income Tax Act 1961.

It is noteworthy that the Finance Minister had announced during his Union Budget-2025 speech that a new Income Tax Bill would be introduced during the Budget session of Parliament. The proposed law will be called the Income Tax Act-2025 and is expected to come into effect in April 2026.