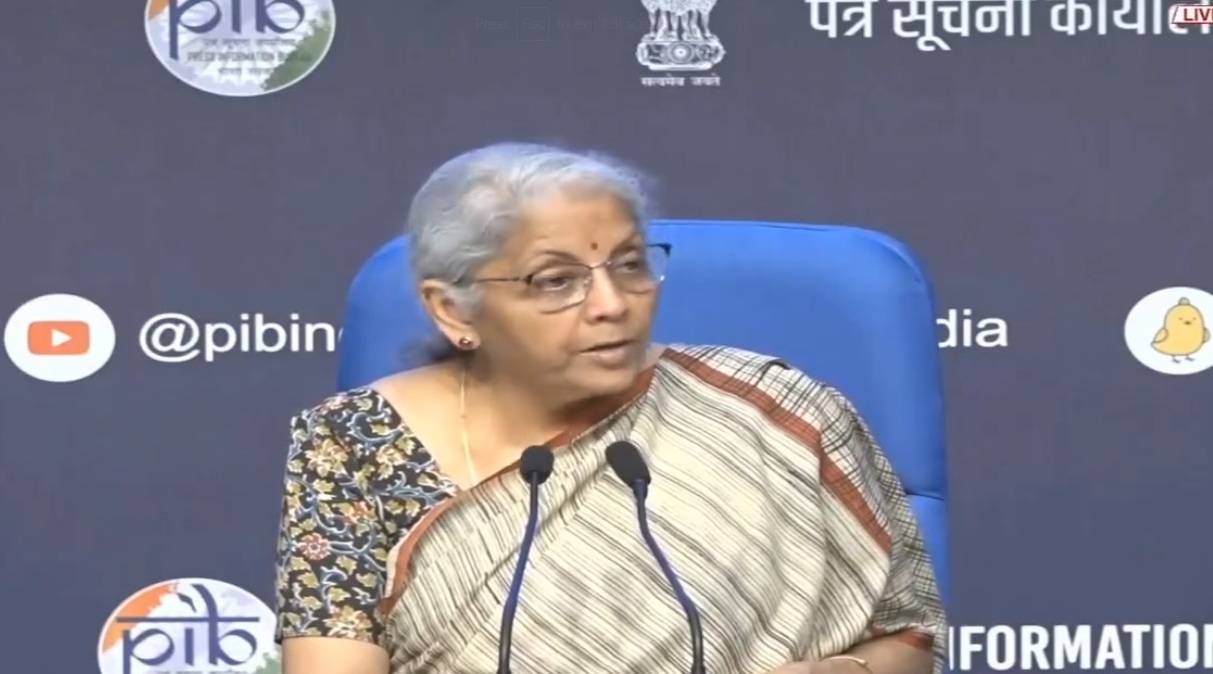

New Delhi, June 22: The Goods and Services Tax (GST) Council met on Saturday under the chairmanship of Union Finance Minister Nirmala Sitharaman.

In the 53rd GST Council meeting, several decisions have been taken to provide relief to taxpayers in terms of trade facilitation, reducing compliance burden and making compliance easier.

In the meeting, GST exemption has been given on some services and a uniform rate of GST has been fixed on some goods. Apart from this, Aadhaar authentication will be rolled out, which will deal with fake companies and fraudulent input tax credit claims.

Online gaming has not been on the agenda of the GST Council. Real-money gaming was imposed at 28 percent GST in October last year. Online gaming companies are waiting for the review of the 28 percent tax system. It has been recommended to fix a uniform rate of 12 percent on all milk cartons i.e. steel, iron, aluminum.

Finance Minister Nirmala Sitharaman informed about the decisions and discussions in a press conference after the meeting. She said that these are called milk cans but wherever they are used, the same rate will be applicable so that there is no dispute. The

Council also recommended setting a uniform GST rate of 12 percent on all carton boxes and both corrugated and non-corrugated paper or paper board. This will especially help apple growers of Himachal Pradesh, Jammu and Kashmir. The GST Council has recommended a 12 percent GST rate on all solar cookers whether it has a single or dual energy source. The

GST Council has exempted services up to Rs 20,000 per person through hostel accommodation outside educational institutions. The condition is that there should be a stay of at least 90 days in these accommodations.

Services provided by Indian Railways such as platform tickets have been exempted from GST. This includes sale of platform tickets, retiring room facilities, waiting rooms, cloakroom services, battery operated car service. Apart from this, intra-railway supplies will also be exempted.

Responding to a question, the Finance Minister said that the government wants petrol and diesel to come under the ambit of GST. It is now up to the states to take a joint decision on this.

The Finance Minister said that to help small taxpayers, the Council has recommended extending the deadline for filing returns and details in GSTR 4 form from April 30 to June 30. This will apply to returns after the financial year 2024-25.

The Council has recommended waiving interest and penalty for demand notices issued under section 73 of the GST Act. This does not include cases related to fraud, suppression or misstatement. The Council has recommended waiving interest and penalty for all notices issued under section 73 for the financial years 2017-18, 2018-19 and 2019-20.

The Minister informed that the time limit for availing input tax credit under section 16(4) of the CGST Act in respect of any invoice or debit note filed upto 30-11-2021 for the financial years 17-18, 18-19, 19-20 and 20-21 may be considered from 2011 to 2021. The Council has made a recommendation for the same requisite amendment with retrospective effect from 01 July 2017. The

Finance Minister informed that biometric-based Aadhaar authentication is going to be introduced on an all India basis. This will help us deal with fraudulent input tax credit claims made through fake invoices in cases.

To reduce government litigation, the Council has recommended monetary limits of Rs 20 lakh for GST Appellate Tribunal, Rs 01 crore for High Court and Rs 02 crore for Supreme Court for filing appeals by the Department. The council has also recommended that the maximum amount of pre-deposit for filing an appeal before the appellate authority will be reduced from Rs 25 crore CGST and SGST to Rs 20 crore.

Sitharaman said that Bihar Deputy Chief Minister Samrat Chaudhary has been made the chairman of the GoM of rate rationalization. In the next meeting, Samrat Chaudhary will submit a status report on the work done for rate rationalization. After this we will start working on rate rationalization.